Equivalent Annual Annuity (EAA)ĮAA calculates the annual cash inflows that a project would generate if it were an annuity over its life.Įach of these methods has its advantages and disadvantages, and businesses may use a combination of methods to evaluate and select investments. MIRR is a variation of IRR that assumes that the project’s cash inflows are reinvested at a predetermined rate. A PI greater than 1 indicates that the project is profitable. PI compares the present value of a project’s cash inflows to the initial investment. This method calculates the time it takes for a project to generate enough cash inflows to recover the initial investment. It is a measure of the project’s profitability. IRR is the discount rate at which the present value of a project’s cash inflows equals the present value of its cash outflows. This method compares the present value of a project’s cash inflows to the present value of its cash outflows, taking into account the time value of money.

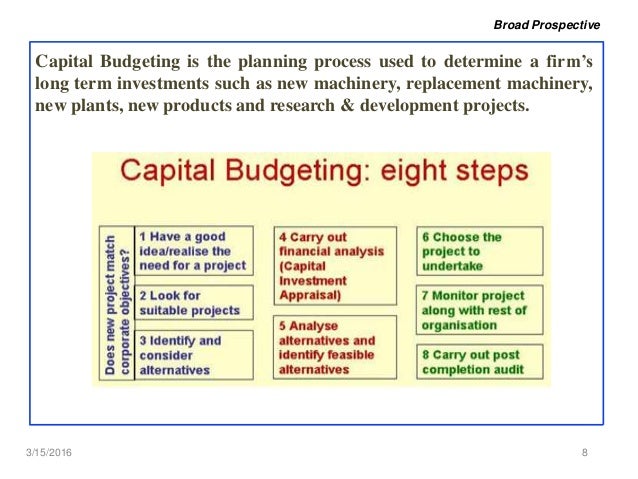

Quick Read: Cash Management System – Types, How It Works and Best Practices Importance of capital budgetingĬapital budgeting helps businesses prioritize investments and allocate financial resources more effectively, reducing the risk of investing in unprofitable projects and maximizing returns. Ultimately, the goal is to choose investments that will help the business grow and thrive. It involves analyzing future cash flows, considering the time value of money, and assessing risks. Basically, it is the process of evaluating potential long-term investment opportunities to determine which ones will generate the most profit for a business.

#Capital planning and budgeting how to

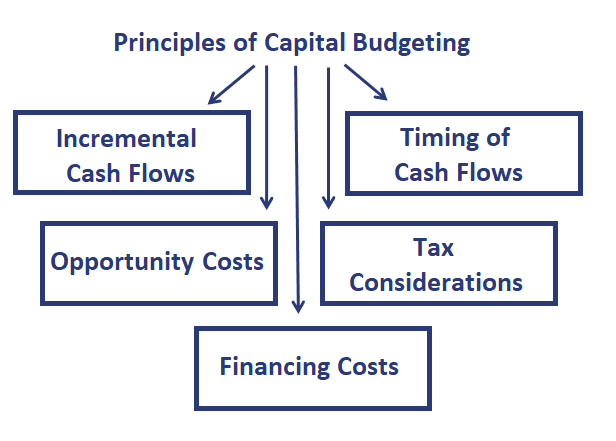

Advantages and Limitations of capital budgetingĬapital budgeting is the art of deciding how to spend your company’s money wisely.Factors affecting capital budgeting decisions.Capital budgeting techniques and methods.

0 kommentar(er)

0 kommentar(er)